IDBI Recovers in July

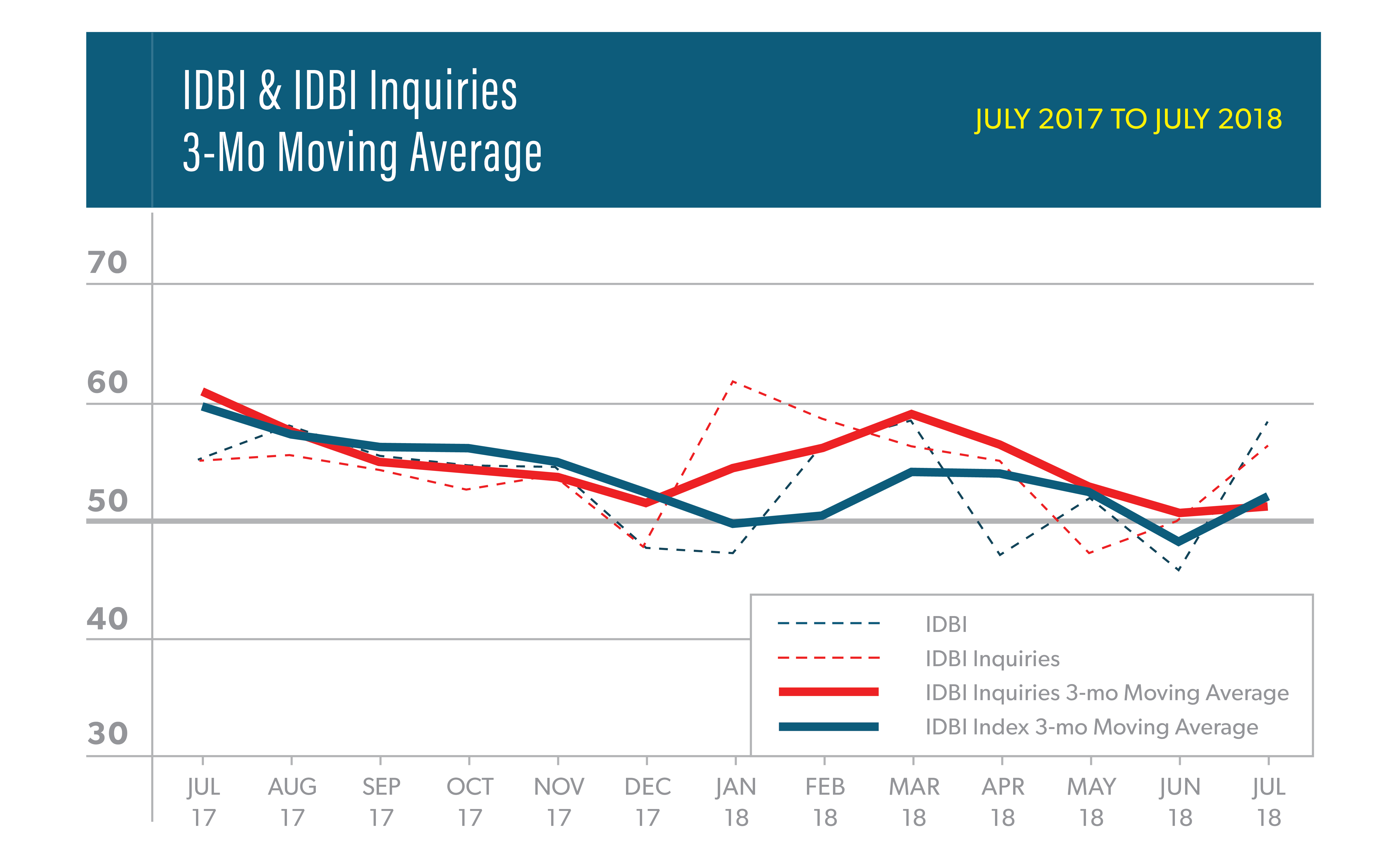

The American Society of Interior Designers’ Interior Design Billings Index (IDBI) rose 12.4 points to a score of 51.7 in July. Following a dip in June, this marks the fourth reading above 50 in the last seven months. The index is above the key breakeven threshold of 50, meaning most firms are experiencing increased billings this summer. The index’s three-month moving average edged up to a score of 52.1, while the new project inquiry index for July rose to a score of 56.3 from 50.7, signaling a potential pick up in design services in the near future.

There was strength across all regions of the U.S. in July, with the exception of the Northeast. Firms in the West took the lead with an increase of 25.6 points in July to a score of 70.6, followed by the Midwest region’s rise of 17.7 points to a score of 57.7, and the South increasing 7.1 points to a score of 57.1. Firms in the Northeast remained steady with a reading of 46.4 in July. All in all, July’s scores reflect strengthening demand for interior design services.

Interestingly, while the July reading showed notable improvement, panelists reduced their optimism on the near term outlook for the design industry. This change in attitude may be due to the expected rise in interest rates and disappointing housing data. The six-month business conditions index score remains in positive territory at 56.9 for July, retreating slightly from the 59.6 reading posted in June.

This month’s special questions asked our survey panelists about business performance over the last six months and their expectations for the second half of 2018. Most respondents, 64 percent, believe their businesses had met expectations or had performed better than expected during the first six months of 2018. Looking forward, four out of ten respondents (42 percent) expect sales to grow between five and ten percent over the next six months. Another one in four (23 percent) expect sales to grow by more than 25 percent. In contrast, nearly one in four respondents (23 percent) expect negative or zero growth in sales in the second half of 2018.